On the other hand, a pattern of declining gross margins may point to increased competition. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The examples and/or scurities quoted (if any) are for illustration only and are not recommendatory. For instance, if you invest ₹10,000 in this fund, the annual fee charged by the company would be ₹150 (i.e.1.5% of ₹10,000). This fee covers the cost of managing the fund, including research, trading, and administrative expenses. The ideal Total Expense Ratio (TER) differs based on the investment strategy and fund type, making it challenging to pinpoint a universally “good” TER.

- In this section, we will discuss how to calculate and interpret the gross profit margin, and how to use it to compare the performance of different businesses or industries.

- It’s the ultimate gauge of how well you manage your expenses relative to the revenue you bring in.

- Each mutual fund has an expense ratio, which can vary depending on the fund’s management style, size, and asset class.

- The gross profit margin does not account for the other expenses that the business incurs, such as marketing, administration, research and development, interest, taxes, and depreciation.

- ROE is a key ratio for shareholders as it measures a company’s ability to earn a return on its equity investments.

Understanding Operating Expense Ratio

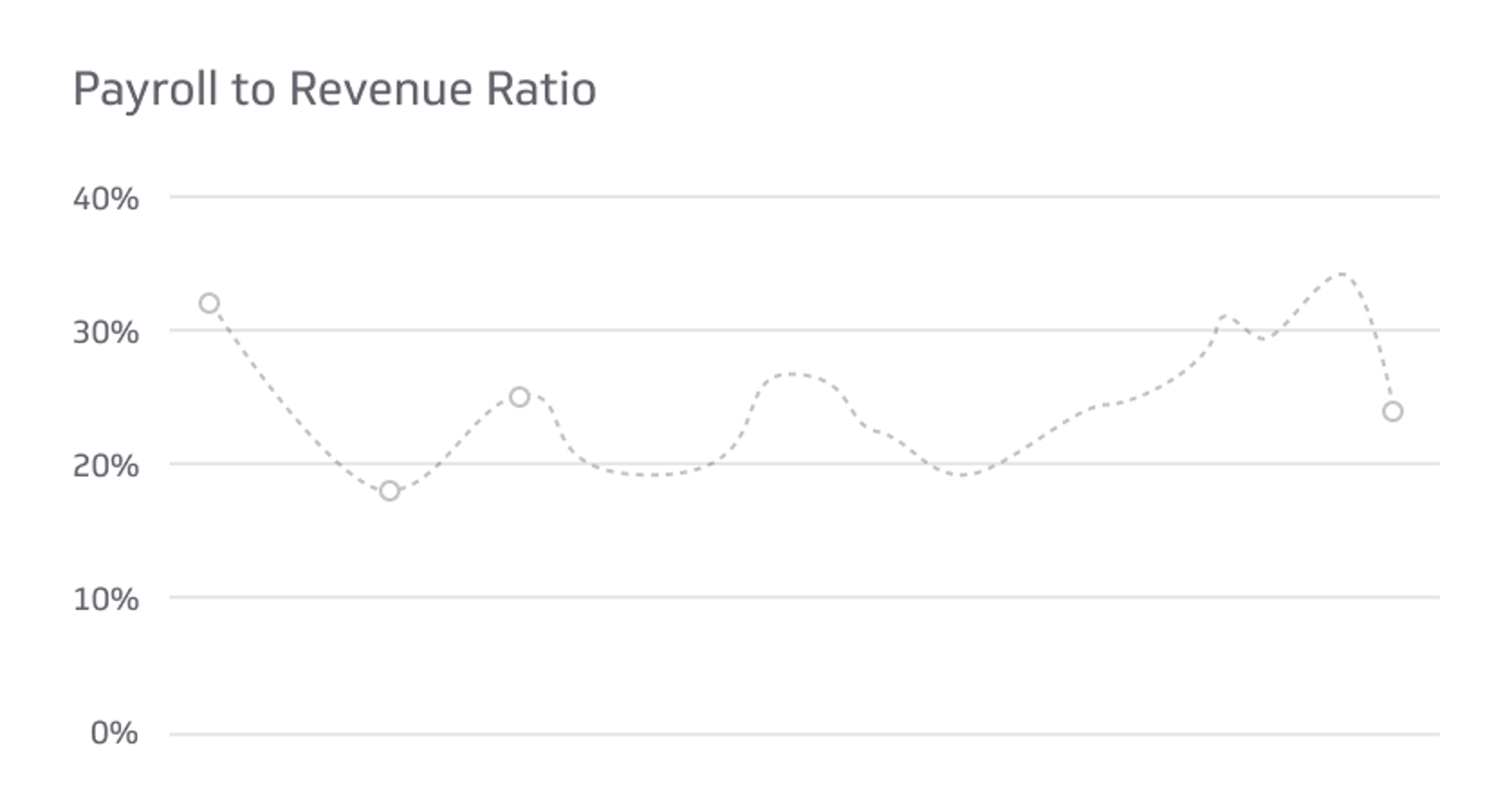

Research and development (R&D) spending is essential for business growth and innovation. All R&D costs are operating expenses, including salaries of research personnel, cost of materials/testing, intellectual property registration fees, and amortization of R&D-related intangibles. Tracking R&D spending is vital, as high R&D expenses can significantly impact a company’s operating expense ratio. Analyzing a company’s operating expense ratio over time can reveal trends in efficiency. As a company grows, operating expenses should not grow at the same pace as sales. A decreasing ratio indicates the company is improving efficiency as sales increase.

What else you should consider about expense ratios

Each week, Zack’s e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. You know how crucial it is to create sales appointments if you own a business or work in sales…. In simpler terms, you can gauge the expected profitability from generating/acquiring leads.

Why it’s important to understand expense ratios

These income statement profit margins include gross margin, operating margin, pretax margin, and net profit margin. The margins between profit and costs expand when costs are low and shrink as layers of additional costs (e.g., cost of goods sold (COGS), operating expenses, and taxes) are taken into consideration. For example, if a mutual fund has total operating expenses of ₹1 crore and average net assets of ₹100 crore, the expense ratio would be 1%. This means that the fund charges 1% of the average net assets as an annual fee to cover its operating expenses. Expense ratios impact the performance of mutual funds and ETFs by reducing the amount of money available for investment growth. Funds with lower expense ratios typically have more of the investors’ money working towards growth, which can lead to higher returns, especially in the long run.

The asset-weighted average expense ratio for actively managed funds was 0.62% in 2020 — for passively managed funds, it was only 0.12%. Index funds are a type of mutual fund or ETF that aims to replicate the performance of a specific market index. They usually have lower expense ratios than actively managed funds, as they require less management and research resources. Exchange-Traded Funds (ETFs) are investment funds that trade on stock exchanges, much like individual stocks. They generally have lower expense ratios than mutual funds, primarily due to their passive management style and lower administrative costs.

Leverage Your POS System To Improve Cost to Revenue Ratios

Businesses with a lower expense-to-revenue ratio are often better positioned to withstand economic downturns, industry changes, as well as competitive pressures. They have the financial strength to adapt and invest in growth opportunities. Putting those data points together, good places to begin include S&P 500 index funds as either an ETF or mutual fund, though an ETF is likely the better option.

The total revenue expenditure may be sub-divided into two categories with fixed and variable. In the case of a fixed expense, the ratio will fall with increase in sales capital gain and for a variable expense, the ratio in proportion to sales shall nearly remain the same. Think of it as a financial compass, guiding you towards profitability.

A low P/E, on the other hand, may indicate its stock price is low relative to its earnings. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. This article has been a guide to what is Operating Expense Ratio Formula. We explain how to calculate it with example, uses with a calculator and formula in excel. We also provide you with an Operating Expense Ratio Calculator with a downloadable excel template.